An analysis of the companys insurance policies showed that 1680 of unexpired insurance coverage remains. The Prepaid Insurance account has a 5000 debit balance to start the year and no insurance payments were made during the year.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-02-21e195b2934c40518828dc904cbdb86f.jpg)

How Are Prepaid Expenses Recorded On The Income Statement

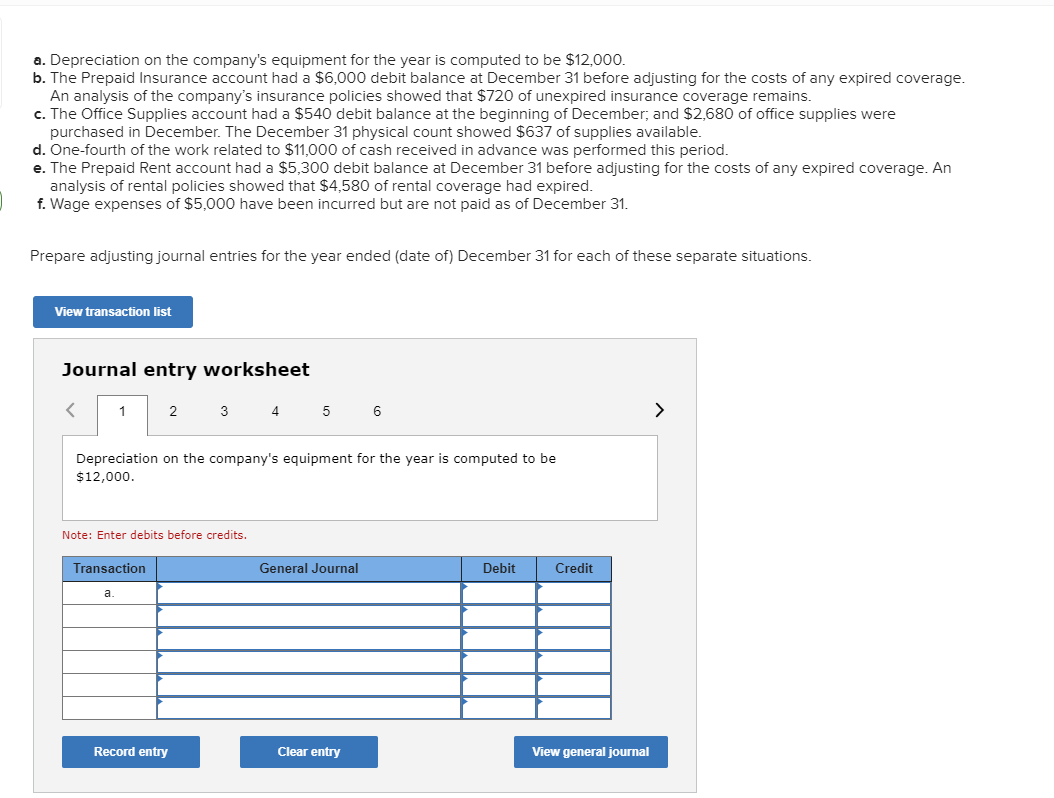

The Prepaid Insurance account had a 6000 debit balance at December 31 2017 before adjusting.

. The account was debited for 6000 for premiums on policies purchased during SolutionInn. Prior to issuing the December 31 financial statements the company must remove the 120. The Prepaid Insurance account had a 6000 debit balance at December 31 before adjusting for the costs of any expired coverage.

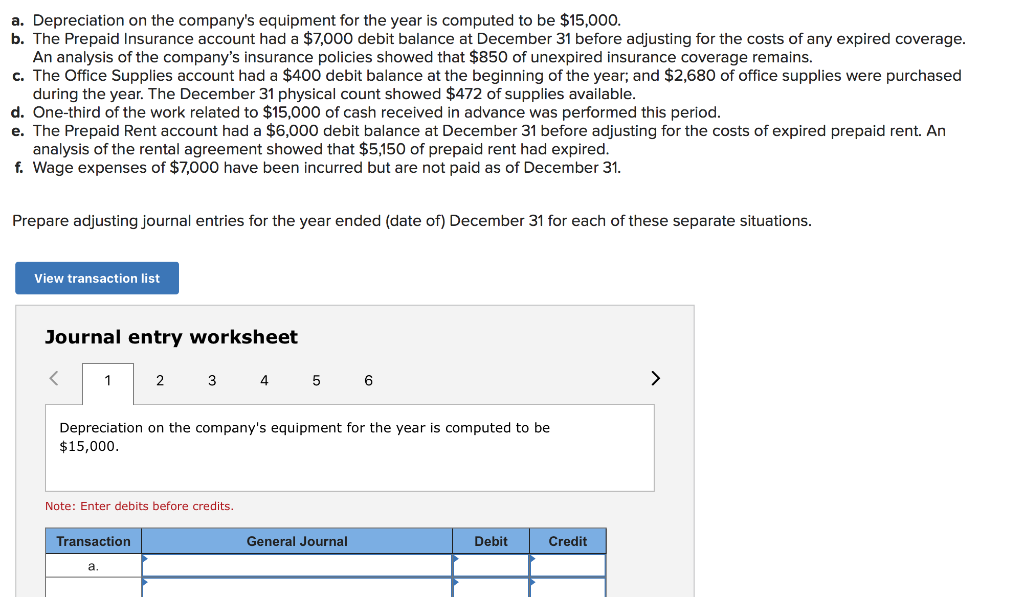

The office supplies account had a 700 debit balance at the beginning of december. The Prepaid Insurance account had a 7000 debit balance at December 31 2017 before adjusting for the costs of any expired coverage. The prepaid insurance account had a balance of 5400 at the beginning of the year.

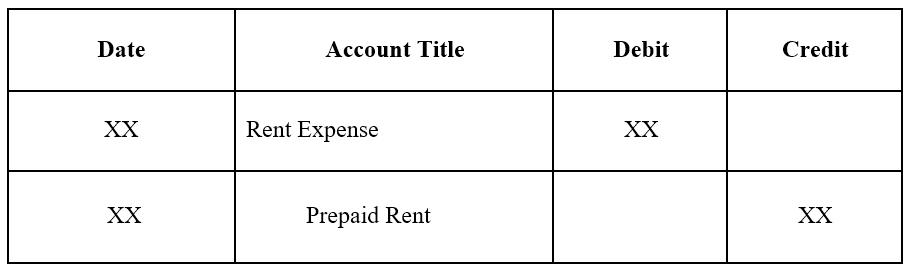

An analysis of the companys insurance policies showed that 1100 of unexpired insurance coverage remainsthe office supplies account had a 700 debit. The December 31 2015 physical count showed 300 of supplies available. The Prepaid Insurance account had a 6000 debit balance at December 31 2015 before adjusting for the costs of any expired coverage.

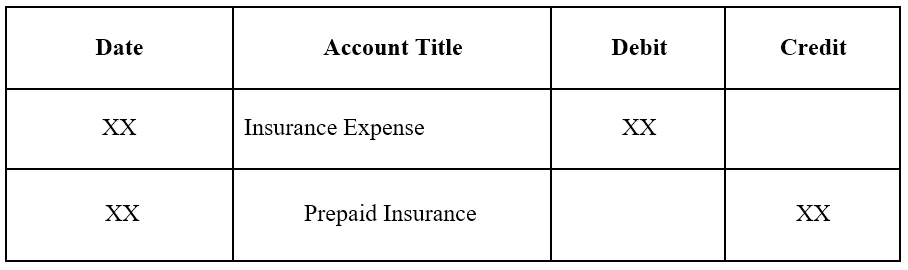

An analysis of insurance. An analysis of the companys insurance policies showed that 1100. In each successive month for the next twelve months there should be a journal entry that debits the insurance expense account and credits the prepaid expenses asset account.

Journalize the adjusting entry include an explanation required at the end of the year assuming the amount of unexpired insurance related to. An analysis of the companys insurance policies showed that 1590 of unexpired insurance coverage remains. An analysis of the companys insurance policies showed that 1220 of unexpired insurance coverage remains.

The balances in the accounts receivable account and allowance for doubtful. The Prepaid Insurance account had a 5000 balance on December 31 201 2. The Office Supplies account had a 410 debit balance on December 31 201 2.

This problem has been solved. And 3480 of office. Depreciation on the companys equipment for 2017 is computed to be 18000the prepaid insurance account had a 6000 debit balance at december 31 2017 before adjusting for the costs of any expired coverage.

The Prepaid Insurance account had a 6000 debit balance at December 31 2017 before adjusting for the costs of any expired coverage. The Office Supplies account had a 700 debit balance on December 31 2014. The account was debited for 6000 for premiums on policies purchased during the year.

The recurring monthly adjusting entries are not changed. A review of insurance policies shows that 1000 of unexpired insurance remains at its December 31 year-end. This unexpired cost is reported in the current asset account Prepaid Insurance.

At December 31 the balance in Prepaid Insurance will be a credit balance of 120 consisting of the debit of 2400 on January 1 the 12 monthly credits of 200 each and the 120 credit on July 1. Depreciation on the companys equipment for 2013 is computed to be 18000. An analysis of the companys insurance policies showed that 1100 of unexpired insurance coverage remains.

During 2013 5223 of office supplies are purchased. And 3480 of office. An analysis of the companys insurance policies showed that 1900 of unexpired insurance coverage remains.

Definition of Prepaid Insurance. The Office Supplies account had a 700 debit balance on December 31 2014. The Prepaid Insurance account had a 9000 debit balance at December 31 before adjusting for the costs of any expired coverage.

The prepaid insurance account had a 6000 debit balance at december 31 before adjusting for the costs of any expired coverage. The initial entry is a debit of 12000 to the prepaid insurance asset account and a credit of 12000 to the cash asset account. Prepaid insurance is the portion of an insurance premium that has been paid in advance and has not expired as of the date of a companys balance sheet.

The prepaid insurance account had a beginning balance of 4500 and was debited for 16600 of premiums paid during the year. The Prepaid Insurance account had a 6000 debit balance at December 31 2015 before adjusting for the costs of any expired coverage. An analysis of the companys insurance policies showed that 1100 of unexpired insurance coverage remains.

The Prepaid Insurance account had a 6000 debit balance at December 31 2013 before adjusting for the costs of any expired coverage. Depreciation on the companys equipment for the year is computed to be 17000. A physical count of supplies at December 31 2013 shows 5572 of supplies available.

Exercise 3-1 Preparing adjusting entries LO P1 a. Depreciation on the companys equipment for the year 2017 is computed to be 11000. As the amount of prepaid insurance expires the expired portion is moved from the.

And 3480 of office supplies were purchased during the year.

Solved A Depreciation On The Company S Equipment For The Chegg Com

Prepaid Expenses Examples Accounting For A Prepaid Expense

Solved A Depreciation On The Company S Equipment For The Chegg Com

0 Comments